Indian Rupee

About The Indian Rupee: The Strong Currency of India

Quick Facts About the Indian Rupee Notes | |

| Country of Origin | India |

| Symbol | ₹ |

| Currency Code | INR |

| Nick Names | |

| Minor units | Paisa |

| Denominations (Banknotes) | ₹1, ₹2, ₹5, ₹10, ₹20, ₹50, ₹100, ₹200, ₹500 and ₹2,000 |

| Motto | |

| Identification Feature | On the reverse side of the ₹500 note, you will find the image of the majestic Red Fort |

| Issuing Bank | Reserve Bank of India |

| In Circulation Since | 1949 |

| INR Exchange Rate | |

The Indian Rupee is the currency that can be spent legally inside the boundaries of India. The Reserve Bank of India is the institution in charge of issuing the new currency. There is also a three-letter ISO currency code for the Indian rupee, which is INR. is the symbol for Indian rupee. The Indian rupee symbol is ₹.

There are many denominations of banknotes that can be printed, ranging from 5 rupees all the way up to 2,000 rupees. On one side of paper rupees, the denominations are printed in Hindi and English, while on the other side, they are printed in a total of 15 different languages.

As the Indian rupee price keeps fluctuating, you can check the Indian rupee rate today for further information.

History of the Indian Rupee

Along with the Chinese wen and the Lydian staters, ancient India was one of the earliest issuers of coins in the globe in the sixth century BCE. This is where the history of the Indian rupee began. The silver rupiya was minted during the reign of Sultan Sher Shah Suri, which lasted from 1540 to 1545 and consisted of five years.

The Imperial Order in Council of 1825, which was issued with the intention of extending the use of British sterling coinage to the colonies of the British Empire, was completely ineffective in India. During this time, the British East India Company had almost complete control over India. Even after the British Empire had been abolished, the silver rupee continued to be used as currency across the entirety of India. The decision made by British India in 1835 to adopt a silver standard based on the rupee coin was influenced by a letter written in 1805 by Lord Liverpool advocating the benefits of mono-metallism. The letter was sent in 1805. The First War of Indian Independence, which took place in 1857, marked the beginning of direct British rule of India. The production of gold sovereigns in vast quantities did not begin until 1851 at the Royal Mint in Sydney.

The British government eventually gave up on its goal of replacing the rupee in India with the pound sterling. As a direct result of the silver crisis that occurred in 1873, a number of countries, including India in the 1890s, adopted a gold exchange standard. Around the year 1875 was the first recorded year when Britain paid India for its exports utilising India Council (paper) Bills.

The panic of 1873, which was triggered by the discovery of vast quantities of silver in the United States and other European territories, resulted in the devaluation of India's national currency, the rupee. As a direct consequence of this, the value of the rupee experienced a dramatic decline. During the Long Depression, which lasted from 1873 until 1897 in Britain, there were several bankruptcies, a rise in the unemployment rate, a stop in the construction of public works, and a considerable decrease in trade.

Independent India has been freely using the Indian rupee for transactions. Since the year 2010, the rupee has been represented by its new symbol. On July 8, 2011, the first coins with the new symbol for the rupee were released into circulation for general use.

Countries Accepting the Indian Rupee

In addition to India, there are various countries where the Indian Rupee is accepted on certain conditions.

Here is a list of the countries where the Indian Rupee is used as the official currency:

Bhutan

Nepal

Bangladesh

Maldives

Zimbabwe

Amount in the Indian Rupee You Should Carry for Your Trip

The sum of money that you could require in order to go about the beautiful country of India is contingent on a number of different elements. The cost of getting to your destination, the cost of your lodging, and the cost of your meals will all have an impact on the holiday spending budget you set aside for yourself. It is possible for a traveller to India on a limited budget to spend roughly INR 2,000 each day there. To put that into perspective, the cost of a single day of vacation can easily surpass INR 10,000 if you choose to travel by expensive modes of transportation, dine at restaurants with Michelin stars, and stay in only the finest hotels. The cost of a trip for two people might range anywhere from INR 4,000 to INR 20,000.

The typical cost of a hotel room in India can range anywhere from INR 1,000 to INR 3,039 per night, depending on the time of year. On the other hand, whether you utilise public transportation or hire a vehicle service, the typical cost of one day's worth of transportation could range anywhere from INR 200 to INR 1,325.

All in all, you can keep an eye on the Live Indian Rupee rate in order to exchange your currency notes. Keep a track of Indian rupee price today for converting the Indian rupee to dollar, Indian rupee to Pakistani rupee, Indian rupee to Sri Lankan rupee, Saudi riyal to Indian rupee today, Indian rupee to Bangladeshi taka, Indian rupee to Canadian dollar, Indian rupee to Nepal currency, Indian rupee to dirham, Indian rupee to Korean won, Indian rupee to philippine peso, Indian rupee to pound, Indian rupee to Sri Lanka, Indian rupee to Vietnam currency, Indian rupee to Australian dollar, Indian rupee to japan currency, Indian rupee to Thailand currency, Indian rupee to AED, Indian rupee to ruble, Indian rupee to Kuwait dinar and Indian rupee to Bhutan currency.

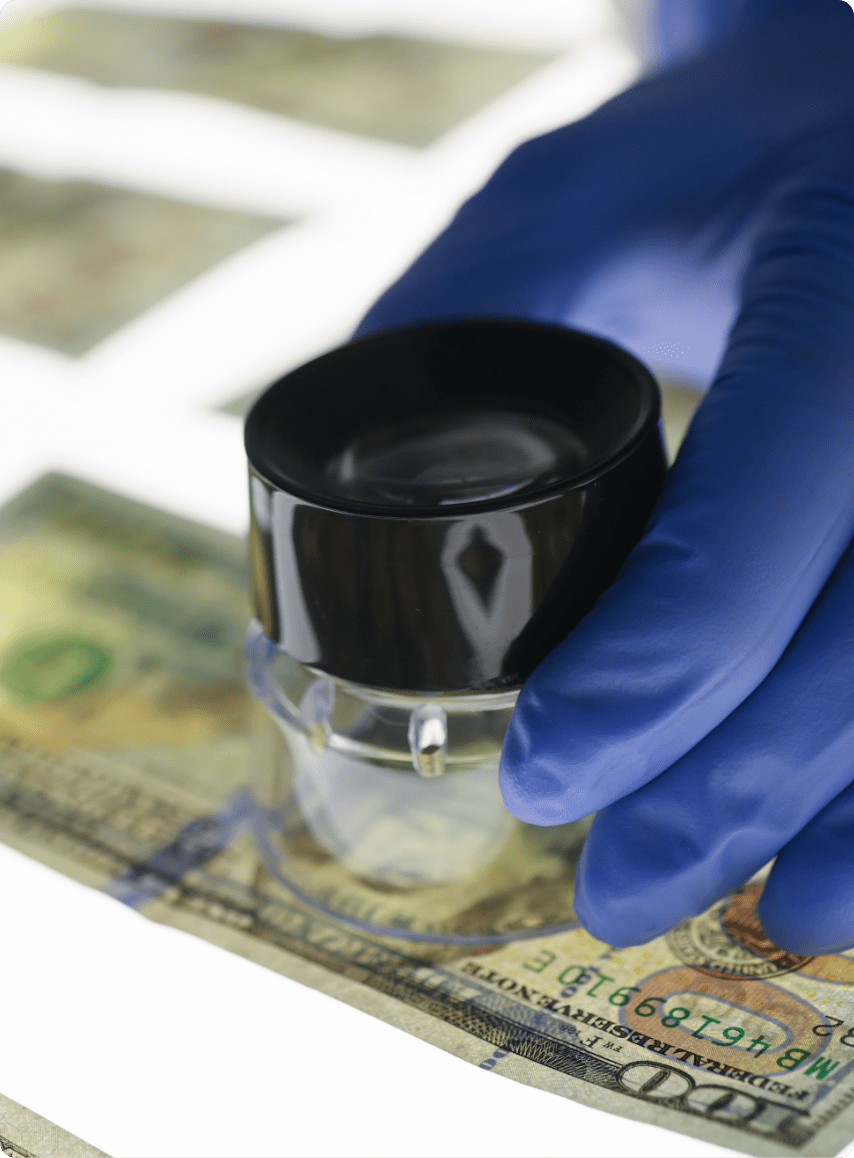

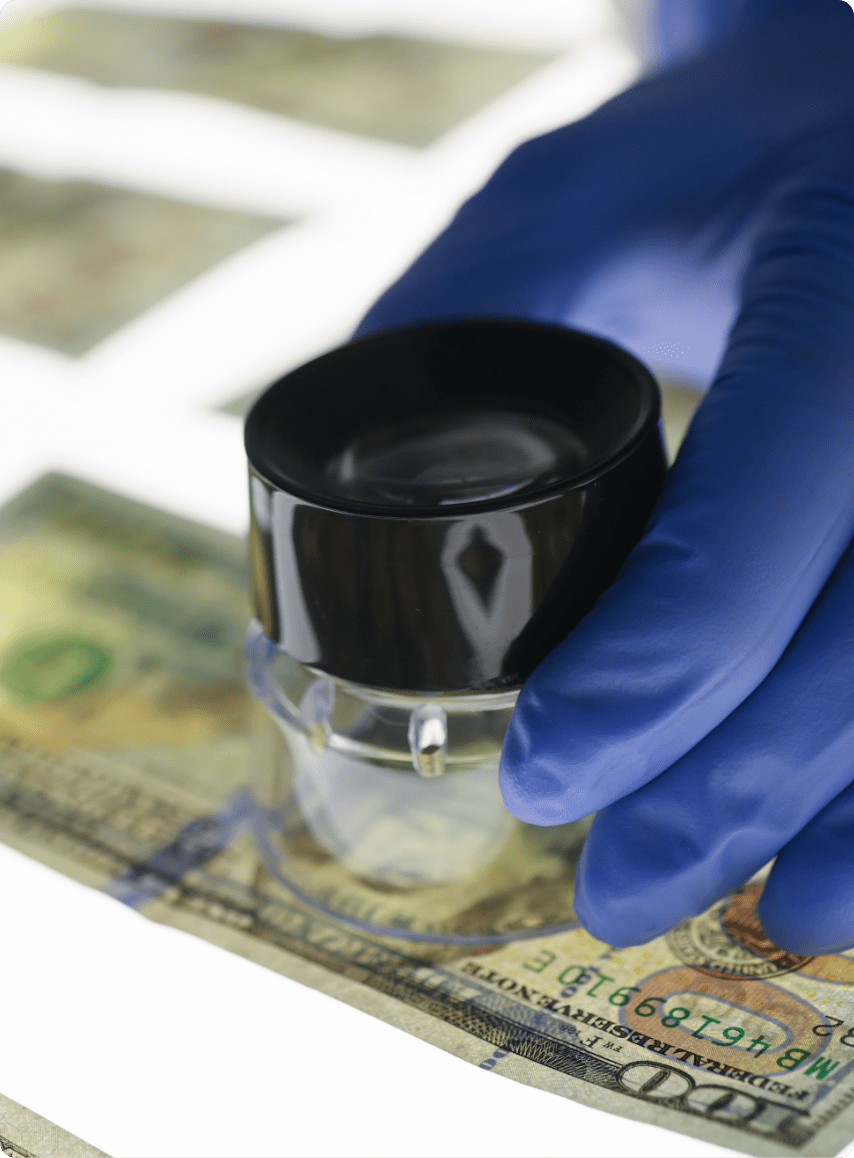

Best Ways to Identify Counterfeit Indian Rupee Notes

There are a few ways through which you can spot the counterfeit Indian Rupee notes:

The profile of Gandhiji is used as a watermark on currency that is minted in India. This watermark allows for the straightforward detection of a counterfeit note. Criminals frequently use thick oils or grease to create fake watermarks on counterfeit currency. As a consequence of this, the watermark takes on an appreciably more substantial appearance. As a result, it is essential to keep one's attention on the watermark. Holding the note up to the light will allow one to determine whether or not the ink used on it is authentic.

If you look closely at this note and see that the numbers aren't lined up properly, you can safely assume that it's a fake. Check to see that all of the numbers are the same size and that there is not a significant amount of space between any of them.

Additionally, the ink that is utilised in the printing process of a currency note ought to be investigated. Authentic banknotes typically have printing that is of the highest quality. Writing that is smudged or lines that are crooked are two examples of telltale evidence that a document has been forged. As a result, you ought to examine the printed information on a note very carefully in order to guarantee that it is genuine.

A banknote often has a row of squares going down the middle of the paper. An encrypted line is precisely what it sounds like a security thread is: a line that is encrypted. In point of fact, the thread of security is woven into the very fabric of the currency that is being used. As a consequence of this, you can use this quality to determine whether or not a note has been forged. On a counterfeit bill, the security thread will have the appearance of being drawn or printed on it.

The typography on a note that claims to be issued by the Reserve Bank of India can be used to determine whether or not the note is genuine. If you examine a genuine banknote alongside a fake one, you will see that the genuine note has text that is written in a much smoother font. In addition, there is micro-lettering on display that connects Gandhiji's face to the words "Reserve Bank of India." The text is very condensed and is shown on a very thin strip. To determine whether or not this print is accurate, you will need to use a magnifying glass.

Process of Exchanging the Indian Rupee

The process of converting the Indian Rupee to Indian Rupee is immensely easy. Please note that the 1 Indian Rupee to INR value is subject to change so keep an eye on the Indian Rupee rate alert. Below, we have mentioned some of the popular ways to convert Indian Rupees to Rupees.

Internationally-Accepted Card

A multi-currency forex card is counted among the most economical and safest way of carrying the Indian Rupee.

The BookMyForex Multi-Currency card can be loaded in 14 currencies and features zero forex mark-up.

Online Forex Marketplace

The simplest and most cost-efficient way of converting your Indian Rupee is using an online forex marketplace such as BookMyForex, a platform by MakeMyTrip, offering the best conversion rates and currency exchange service. The platform offers a 5-minute fully-digital online process for currency exchange.

Visiting Your Bank

The most traditional way of converting the Indian Rupee to Rupee is by visiting a bank and standing in long queues. It is not only time-consuming but you also end up paying a high cost for making the Indian Rupee convert to Indian Rupees.

Local Money Changers

You can look for an Authorised Dealer Category II or someone who has a money changers licence. Money exchangers offer competitive Indian Rupee exchange rates, and you’d not need a bank account in this case. However, the process of rate haggling can be quite frustrating for those who are looking for an easy way to convert Indian Rupee to INR.

On the other hand,BookMyForex, the online marketplace, offers internationally-accepted forex card and currency notes at the best rates via a convenient online process.

Airport

If you would like to convert the Indian Rupee in India, one of the costliest ways to do so would be to get the Indian Rupee exchanged at an airport due to the exorbitantly high INR exchange rates. Currency exchange at the airport will prove to be 5%-15% costlier than BookMyForex.

Exchange the Indian Rupee with BookMyForex

BookMyForex, the online forex marketplace by MakeMyTrip, makes it a hassle-free affair for you to convert the INR to Indian Rupees as well as Indian Rupee to Indian Rupee. Please note that the 1 Indian Rupee to INR value is subject to change so keep an eye on the Indian Rupee rate alert. You should choose MakeMyTrip for currency exchange for the following reasons:

Wide Range of Products

Forex (Currency Notes) - Available in 100+ cities across India, BookMyForex allows you to get your currency notes delivered on the same day or the next day after 100% digital booking.

BookMyForex Multi-Currency Card - You can load this card in 14 currencies with 0% Forex Mark-up. Once you have booked this card, you can receive it the same day (if booking is made before 1 PM) or the next.

International Travel Insurance - MakeMyTrip also offers international travel insurance at cheapest rates in the market. Also, you can opt for this product if you’d like MMT to handle your mandatory travel insurance requirements along with a VISA application.

Travel Loan - With TripMoney, you can avail a travel loan of up to INR 1,00,000 (lifetime limit) for all your travel and holiday needs.

Best Exchange Rates

BookMyForex makes it easy for you to buy Indian Rupee or sell Indian Rupee at live and best exchange rates.

Quick Money Transfer

You can also enjoy quick international money transfers on BookMyForex. The 5-minute digital process offers the best forex rates, and you can receive funds abroad within 12 to 48 hours.

Home Delivery

BookMyForex delivers the Indian Rupees at your doorstep. So, you can simply order and receive your currency from the comfort of your home.

Best Rates to Exchange the Indian Rupee

You’d need to keep an eye on the current currency rates, if you’d like to know the exact value you’d get on converting 1 Indian Rupee in Rupees. The exchange rates keep on fluctuating. BookMyForex, an online forex marketplace by MakeMyTrip, keeps you updated with the live currency exchange rates. You can keep up with the changing value of 1 Indian Rupee in India in real-time on the platform and get the best deal. Currently, 1 INR is equivalent to ⚠️ INR .

Best Ways to Carry the Indian Rupee

BookMyForex allows you to convert INR to the Indian Rupee at the best exchange rates so that you can carry the Indian Rupees without any hassle. Some of the best ways to carry the Indian Rupee are mentioned below:

Currency Notes

You can buy the US Dollar notes at live and best exchange rates on BookMyForex so that you can be ready for your trip with sufficient cash in your hand.

BookMyForex Multi-Currency Card - 0% Forex Mark-Up

The Multi-Currency Forex Travel Card available on MakeMyTrip with BookMyForex as the co-branding partner comes with 0% forex mark-up over interbank rates.

How to Buy the Indian Rupee at Best Rates - Currency Notes and Cards

Whether you want to buy forex cards and currency notes or sell the Indian Rupee, MakeMyTrip makes the entire process quite easy. It doesn’t matter whether you want to convert the Indian rupee to US dollar, Indian rupee to PKR, Indian rupee to Japanese yen, Indian rupee to Nepal, Indian rupee to Nepal rupee, Indian rupee to Russian ruble and INR to Indian Rupee or Indian Rupee to Euro, you only need to follow the below-written steps:

- STEP 01

Select your city from the drop-down list.

- STEP 02

Choose the currency you have and the currency you want.

- STEP 03

Opt for a forex card or currency notes from the list.

- STEP 04

Mention the forex amount. The live currency exchange rate will show up next to it.

- STEP 05

The converted currency amount according to the exchange rate will show up automatically.

- STEP 06

Then proceed with booking your order.

Documents Required to Buy or Sell the Indian Rupee

Here are some important documents mandated by the RBI that you must submit in order to buy or sell the Indian Rupee in India.

Copies of your valid Indian passport

PAN Card

Confirmed air ticket indicating your plan to travel within 60 days

Valid visa (it may not be required for every country)

Different Purposes for Exchanging the Indian Rupee

Private Travel: You can avail of up to INR 10,000 for a private trip to the India.

Studying Abroad: You can purchase foreign exchange of up to INR 30,000 or up to the estimate shared by your educational institute.

Employment Purpose: In case you have a letter of employment, you can buy foreign exchange of up to INR 5,000.

Emigration: If you have an emigration visa, you can buy foreign exchange for up to INR 5,000.

Gift and Donation: You can gift or donate up to INR 5,000 annually on the basis of self-certification

Medical Treatment: On the basis of self-certification, you can buy foreign exchange of up to INR 50,000 for medical treatments outside of India. Once the limit is surpassed, you have to provide the estimated expense that would be incurred at the hospital.

Buy and Sell the Indian Rupee Online at Best Exchange Rates

With BookMyForex, the online forex marketplace by MakeMyTrip, you can easily convert your currency. Enjoy unbeatable currency exchange rates and opt for BookMyForex Multi-Currency Cards as well as foreign currency notes. with no forex mark-up. MakeMyTrip also present the real-time value of one Indian Rupee in Indian Rupees so that you can stay updated with the ever-changing Indian Rupee value when converting your money to other currencies.

Home Delivery of the Indian Rupee

In addition to a smooth online process, BookMyForex also delivers the Indian Rupees right at your doorstep. In fact, you can enjoy same-day door delivery. So, you do not have to waste any time visiting a local money exchanger and picking up your money.

Other currencies to INR Conversion

Frequently Asked Questions

What is the currency of India?

The official currency of India is the Indian Rupee (INR). It's used for all kinds of transactions across India, from shopping to dining and travel.

How do I get cashback after placing my forex order?

Find out more about the cashback offer on your Indian Rupee (INR) purchase by clicking here.

What is the best way to convert INR to INR?

You can convert INR to INR using different methods such as visiting a nearby bank or an airport counter. However, both of these methods will prove to be time-consuming as well as costly. There are local money exchangers available but you might need to indulge in negotiations with them. Therefore, MakeMyTrip, powered by BookMyForex, is the perfect way to convert your currency. This online Forex solution offers currency exchange at live rates and delivers currency notes or Forex cards to your doorstep.

What will happen to the leftover Indian Rupee currency when I return from my trip?

You can easily exchange any leftover currency notes or the money left in your Forex card with MakeMyTrip, powered by BookMyForex, once you have returned from your trip.

Can I invest in the Indian Rupee?

Yes, you can invest in the Indian Rupee via mutual funds, ETFs, or ETNs. However, you should keep an eye on market fluctuation and geopolitical concerns.

Will I receive authentic Indian Rupee notes?

Yes. MakeMyTrip offers genuine notes from RBI-licensed companies only.

Is it legally allowed to hold Indian Rupee in India?

While it is acceptable to hold the Indian Rupee up to the amount authorised by RBI, you cannot use this currency for any kind of transaction in India.

What if I run out of the Indian Rupee currency while travelling?

If you are carrying a MakeMyTrip multi-currency Forex card while travelling, then you can easily load it up and receive the money abroad within 48 hours.