Naira

About The Naira: The Strong Currency of Nigeria

Quick Facts About the Naira Notes | |

| Country of Origin | Nigeria |

| Symbol | ₦ |

| Currency Code | NGN |

| Nick Names | |

| Minor units | Kobo |

| Denominations (Banknotes) | ₦5, ₦10, ₦20, ₦50, ₦100, ₦200, ₦500 and ₦1000 |

| Motto | |

| Identification Feature | The inclusion of a woman's signature on a naira note in 2019 was a historic first for the country's currency. Priscilla Ekwere Eleje, who serves as the Director of Currency Operations at the Central Bank of Nigeria, was given the honour of receiving this achievement. |

| Issuing Bank | Central Bank of Nigeria |

| In Circulation Since | July 1, 1959 |

Nigeria is a nation that is a part of the Commonwealth of Nations, and their national currency is called the naira (NGN). It takes one hundred kobo to equal one naira in Nigeria's monetary system, which is based on the naira. Only the Central Bank of Nigeria is authorised to issue currency that can be used within the Federal Republic of Nigeria. It does this by regulating the flow of currency into the economy, which helps keep inflation and unemployment from getting out of control. The Naira symbol is ₦.

Since its introduction in 1973 till the present day (2019), the value of the naira has been steadily eroded, and inflation remains higher than 10%.

Since 2007, circulation has been maintained for the 50 kobos, 1 naira, and 2 naira coins respectively. Banknotes for the naira come in denominations of 5, 10, 20, 50, 100, 200, and 500; the banknotes for the 50 kobo and the 1 naira are no longer valid forms of payment.

The Naira rate today is INR (0 ) . Please note that Naira rate keeps on fluctuating so you can check the Naira price on the platform.

History of the Naira

The Nigerian pound was replaced by the naira on January 1, 1973, and the exchange rate for one naira to one dollar was set at 1:1. The name of Queen Elizabeth II appeared on the obverse of every single Nigerian pound coin that was put into circulation before to the year 1960. These coins were minted by the colonial government of the Federation of Nigeria.

The new currency coins were the first coins to be struck by an independent Nigeria after the country gained its independence in 1960. Because of this, Nigeria was the very last country to make the transition from the pound sterling to the decimal system.

The Nigerian naira became the country's official currency in 1973, succeeding the British pound as the nation's previous unit of account. The value of one naira was determined to be equivalent to two pounds sterling when determining an exchange rate between the two currencies.

By the year 2008, the value of the money had been drastically diminished due to inflation. The government eventually decided to shelve its plans to establish the exchange rate at 100 old nairas for every new naira; nevertheless, these plans had been in the works for some time.

Because of the political upheaval in the country in 2008, the redenomination of the naira at a rate of 100:1 was put on hold.

On June 20th, 2016, the naira was finally allowed to float after having its value pegged at 197 dollars to one naira for some time. A number of market participants anticipated that the equilibrium rate of the naira would be somewhere in the range of 280 and 350 per dollar. Also, the introduction of the eNaira, Nigeria's digital currency, was scheduled for October 2021 in the country.

Countries Accepting the Naira

Naira is the official currency of Nigeria. Due to this reason, it is used in this country for various transactions as well as the sale and purchase of goods and services.

Amount in the Naira You Should Carry for Your Trip

There are a lot of factors that go into determining how much spending money you'll need for a vacation to the lovely country of Nigeria. The cost of getting to your destination, the cost of your lodging, and the cost of your meals will all have an impact on the holiday spending budget you set aside for yourself.

It is possible to get by in Nigeria on as little as NGN 30,000 a day, even for those who are on a tight schedule. On the other hand, the cost of a single day of vacation can easily surpass NGN 40,000 if you utilise premium forms of transportation, dine at restaurants with Michelin stars, and stay in only the finest hotels. Also, the cost of a vacation for two people can reach over NGN 60,000 to NGN 1,00,000.

The cost of accommodation in Nigeria can range anywhere from approximately NGN 12,000 to NGN 20,000 per person, per day. On the other hand, the cost of transportation on a daily basis could range anywhere from NGN 3,000 to NGN 7,000, and this figure is contingent on whether you take public transit or a private vehicle.

All in all, you can keep an eye on the live Naira rate in order to exchange your currency notes. You can check Naira to dollar and Naira to rupees on the platform.

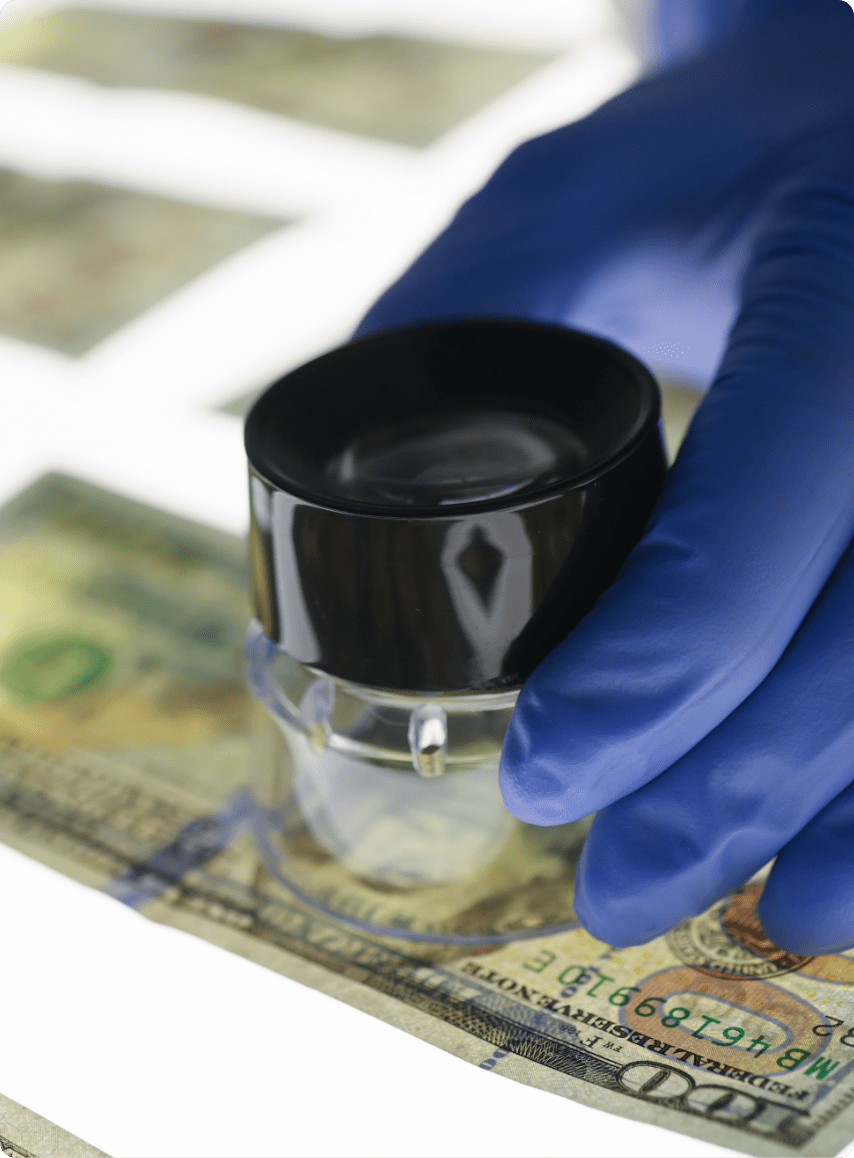

Best Ways to Identify Counterfeit Naira Notes

There are a few ways through which you can spot the counterfeit Naira notes:

A counterfeit note's surface feels squishy and the image on the front appears to be faded.

Signature of the governor of the Central Bank of Nigeria (CBN) and a gold foil seal can be found on the right side of the N1,000 note. If you scratch a counterfeit note, the gold foil will peel off instantly, whereas the gold foil on the genuine article will not come off at all.

The use of water or another liquid, in addition to this method, is helpful in detecting counterfeit money. Because the inks that are used to make counterfeit bills are easily erased by water and other substances, criminals put these notes back into circulation.

Soaking a Naira bill in water or gasoline and then lightly scraping it will allow you to determine whether or not it is genuine. If it is a fake, you can immediately tell since the colours will be different. Because the ink on counterfeit bills is water-based, it will wear off over time, just like a watercolour painting would.

There is a thin, ribbon-like thread that runs vertically from the top to the bottom of each and every Naira banknote. This thread can be physically felt in authentic notes. Older banknotes of the Naira are where you'll truly see it, so look for those. On the other hand, fake notes have a thread that, despite its apparent similarity to the real one, does not actually exist.

When a genuine N1000 bill is held up to the light, the numeral "1000" that is printed across the bill will be revealed to be in dazzling relief throughout the note.

Process of Exchanging the Naira

The process of converting the Naira to Indian Rupee is immensely easy. Please note that the 1 Naira to INR value is subject to change so keep an eye on the Naira rate alert. Below, we have mentioned some of the popular ways to convert Nairas to Rupees.

Internationally-Accepted Card

A multi-currency forex card is counted among the most economical and safest way of carrying the Naira.

The BookMyForex Multi-Currency card can be loaded in 14 currencies and features zero forex mark-up.

Online Forex Marketplace

The simplest and most cost-efficient way of converting your Naira is using an online forex marketplace such as BookMyForex, a platform by MakeMyTrip, offering the best conversion rates and currency exchange service. The platform offers a 5-minute fully-digital online process for currency exchange.

Visiting Your Bank

The most traditional way of converting the Naira to Rupee is by visiting a bank and standing in long queues. It is not only time-consuming but you also end up paying a high cost for making the Naira convert to Indian Rupees.

Local Money Changers

You can look for an Authorised Dealer Category II or someone who has a money changers licence. Money exchangers offer competitive Naira exchange rates, and you’d not need a bank account in this case. However, the process of rate haggling can be quite frustrating for those who are looking for an easy way to convert Naira to INR.

On the other hand,BookMyForex, the online marketplace, offers internationally-accepted forex card and currency notes at the best rates via a convenient online process.

Airport

If you would like to convert the Naira in India, one of the costliest ways to do so would be to get the Naira exchanged at an airport due to the exorbitantly high NGN exchange rates. Currency exchange at the airport will prove to be 5%-15% costlier than BookMyForex.

Exchange the Naira with BookMyForex

BookMyForex, the online forex marketplace by MakeMyTrip, makes it a hassle-free affair for you to convert the NGN to Indian Rupees as well as Indian Rupee to Naira. Please note that the 1 Naira to INR value is subject to change so keep an eye on the Naira rate alert. You should choose MakeMyTrip for currency exchange for the following reasons:

Wide Range of Products

Forex (Currency Notes) - Available in 100+ cities across India, BookMyForex allows you to get your currency notes delivered on the same day or the next day after 100% digital booking.

BookMyForex Multi-Currency Card - You can load this card in 14 currencies with 0% Forex Mark-up. Once you have booked this card, you can receive it the same day (if booking is made before 1 PM) or the next.

International Travel Insurance - MakeMyTrip also offers international travel insurance at cheapest rates in the market. Also, you can opt for this product if you’d like MMT to handle your mandatory travel insurance requirements along with a VISA application.

Travel Loan - With TripMoney, you can avail a travel loan of up to INR 1,00,000 (lifetime limit) for all your travel and holiday needs.

Best Exchange Rates

BookMyForex makes it easy for you to buy Naira or sell Naira at live and best exchange rates.

Quick Money Transfer

You can also enjoy quick international money transfers on BookMyForex. The 5-minute digital process offers the best forex rates, and you can receive funds abroad within 12 to 48 hours.

Home Delivery

BookMyForex delivers the Nairas at your doorstep. So, you can simply order and receive your currency from the comfort of your home.

Best Rates to Exchange the Naira

You’d need to keep an eye on the current currency rates, if you’d like to know the exact value you’d get on converting 1 Naira in Rupees. The exchange rates keep on fluctuating. BookMyForex, an online forex marketplace by MakeMyTrip, keeps you updated with the live currency exchange rates. You can keep up with the changing value of 1 Naira in India in real-time on the platform and get the best deal. Currently, 1 NGN is equivalent to 0 INR .

Best Ways to Carry the Naira

BookMyForex allows you to convert INR to the Naira at the best exchange rates so that you can carry the Nairas without any hassle. Some of the best ways to carry the Naira are mentioned below:

Currency Notes

You can buy the US Dollar notes at live and best exchange rates on BookMyForex so that you can be ready for your trip with sufficient cash in your hand.

BookMyForex Multi-Currency Card - 0% Forex Mark-Up

The Multi-Currency Forex Travel Card available on MakeMyTrip with BookMyForex as the co-branding partner comes with 0% forex mark-up over interbank rates.

How to Buy the Naira at Best Rates - Currency Notes and Cards

Whether you want to buy Naira forex cards and currency notes or sell the Naira, MakeMyTrip makes the entire process quite easy. It doesn’t matter whether you want to convert the Naira to USD, INR to Naira or Naira to Euro, you only need to follow the below-written steps:

- STEP 01

Select your city from the drop-down list.

- STEP 02

Choose the currency you have and the currency you want.

- STEP 03

Opt for a forex card or currency notes from the list.

- STEP 04

Mention the forex amount. The live currency exchange rate will show up next to it.

- STEP 05

The converted currency amount according to the exchange rate will show up automatically.

- STEP 06

Then proceed with booking your order.

Documents Required to Buy or Sell the Naira

Here are some important documents mandated by the RBI that you must submit in order to buy or sell the Naira in India.

Copies of your valid Indian passport

PAN Card

Confirmed air ticket indicating your plan to travel within 60 days

Valid visa (it may not be required for every country)

Different Purposes for Exchanging the Naira

Private Travel: You can avail of up to NGN 10,000 for a private trip to the Nigeria.

Studying Abroad: You can purchase foreign exchange of up to NGN 30,000 or up to the estimate shared by your educational institute.

Employment Purpose: In case you have a letter of employment, you can buy foreign exchange of up to NGN 5,000.

Emigration: If you have an emigration visa, you can buy foreign exchange for up to NGN 5,000.

Gift and Donation: You can gift or donate up to NGN 5,000 annually on the basis of self-certification

Medical Treatment: On the basis of self-certification, you can buy foreign exchange of up to NGN 50,000 for medical treatments outside of India. Once the limit is surpassed, you have to provide the estimated expense that would be incurred at the hospital.

Buy and Sell the Naira Online at Best Exchange Rates

With BookMyForex, the online forex marketplace by MakeMyTrip, you can easily convert your currency. Enjoy unbeatable currency exchange rates and opt for BookMyForex Multi-Currency Cards as well as foreign currency notes. with no forex mark-up. MakeMyTrip also present the real-time value of one Naira in Indian Rupees so that you can stay updated with the ever-changing Naira value when converting your money to other currencies.

Home Delivery of the Naira

In addition to a smooth online process, BookMyForex also delivers the Nairas right at your doorstep. In fact, you can enjoy same-day door delivery. So, you do not have to waste any time visiting a local money exchanger and picking up your money.

Other currencies to INR Conversion

Frequently Asked Questions

What is the currency of Nigeria?

The official currency of Nigeria is the Naira (NGN). It's used for all kinds of transactions across Nigeria, from shopping to dining and travel.

How do I get cashback after placing my forex order?

Find out more about the cashback offer on your Naira (NGN) purchase by clicking here.

What is the best way to convert NGN to INR?

You can convert NGN to INR using different methods such as visiting a nearby bank or an airport counter. However, both of these methods will prove to be time-consuming as well as costly. There are local money exchangers available but you might need to indulge in negotiations with them. Therefore, MakeMyTrip, powered by BookMyForex, is the perfect way to convert your currency. This online Forex solution offers currency exchange at live rates and delivers currency notes or Forex cards to your doorstep.

What will happen to the leftover Naira currency when I return from my trip?

You can easily exchange any leftover currency notes or the money left in your Forex card with MakeMyTrip, powered by BookMyForex, once you have returned from your trip.

Can I invest in the Naira?

Yes, you can invest in the Naira via mutual funds, ETFs, or ETNs. However, you should keep an eye on market fluctuation and geopolitical concerns.

Will I receive authentic Naira notes?

Yes. MakeMyTrip offers genuine notes from RBI-licensed companies only.

Is it legally allowed to hold Naira in India?

While it is acceptable to hold the Naira up to the amount authorised by RBI, you cannot use this currency for any kind of transaction in India.

What if I run out of the Naira currency while travelling?

If you are carrying a MakeMyTrip multi-currency Forex card while travelling, then you can easily load it up and receive the money abroad within 48 hours.